In the age of global e-commerce, expanding one’s business beyond national borders presents numerous opportunities but also complexities, especially in terms of tax and administrative compliance.

A Merchant of Record (MOR) can significantly simplify this process, making it much easier to enter the international market.

Merchant of Record: what it is

A Merchant of Record is alegal entity that acts as an official seller of goods or services to end consumers.

This role involves responsibility for managing financial transactions, VAT collection, customs, and regulatory compliance in different countries.

Using a MOR eliminates the need for vendors to establish separate legal entities in each country, greatly simplifying international expansion.

The Merchant of Record, also known as MOR, offers an advantageous option for making sales (especially online), freeing sellers from burdensome operational tasks such as administrative and tax tasks.

Through the MOR, sellers can use a VAT Number made available to them, making the MOR the entity that actually finalizes the transaction with the consumer.

In this capacity, it assumes legal and fiscal responsibility for the operation, managing all related obligations accordingly, such as VAT record keeping, right of withdrawal and warranty regulations, as well as privacy and data processing aspects, in accordance with applicable legal provisions.

Which companies rely on the Merchant of Record?

Companies using the Merchant of Record service are of two types:

- B2B companies., which often lack the necessary infrastructure for online sales, can take advantage of Merchant of Record (MOR) to make operations more efficient and simplify customer interactions.

- B2C Companies geared toward international expansion. These can benefit from a Merchant of Record, which facilitates simplified tax and legal procedures. Dealing with foreign sales often involves the need for country-specific tax representation and handling related paperwork.

The advantages

The use of a Merchant of Record offers a number of key benefits, significantly improving the operations of companies that choose to rely on this solution. Here is a structured overview of the main advantages:

Simplification of Processes:

- Tax and Legal Compliance.: MOR assumes responsibility for regulatory compliance in each market, thus minimizing legal risks for the seller.

- Transaction Management: Includes payment processing, local currency management and dispute resolution, significantly simplifying these complex operations.

- Operational Efficiency: MOR reduces the administrative burden on the vendor, allowing companies to focus on their core business.

Skills Expansion:

- Access to Specialized Experience.: Companies benefit from MOR’s deep knowledge and experience in various aspects of international trade and online management.

- Customer Service Delegation.: The MOR manages all interactions with the end consumer, including customer service and after-sales support, ensuring a high-quality user experience.

Qualitative and Content Control:

- Content Supervision.: Companies can maintain control over the quality and content of products offered

Infrastructure for Internationalization:

- Leveraging Existing Tax Structures.: Using an MOR, companies can easily expand internationally, taking advantage of already established tax infrastructure optimized for global expansion.

Together, these elements provide a solid foundation for companies looking to expand their global market presence while simultaneously reducing risk and administrative burden.

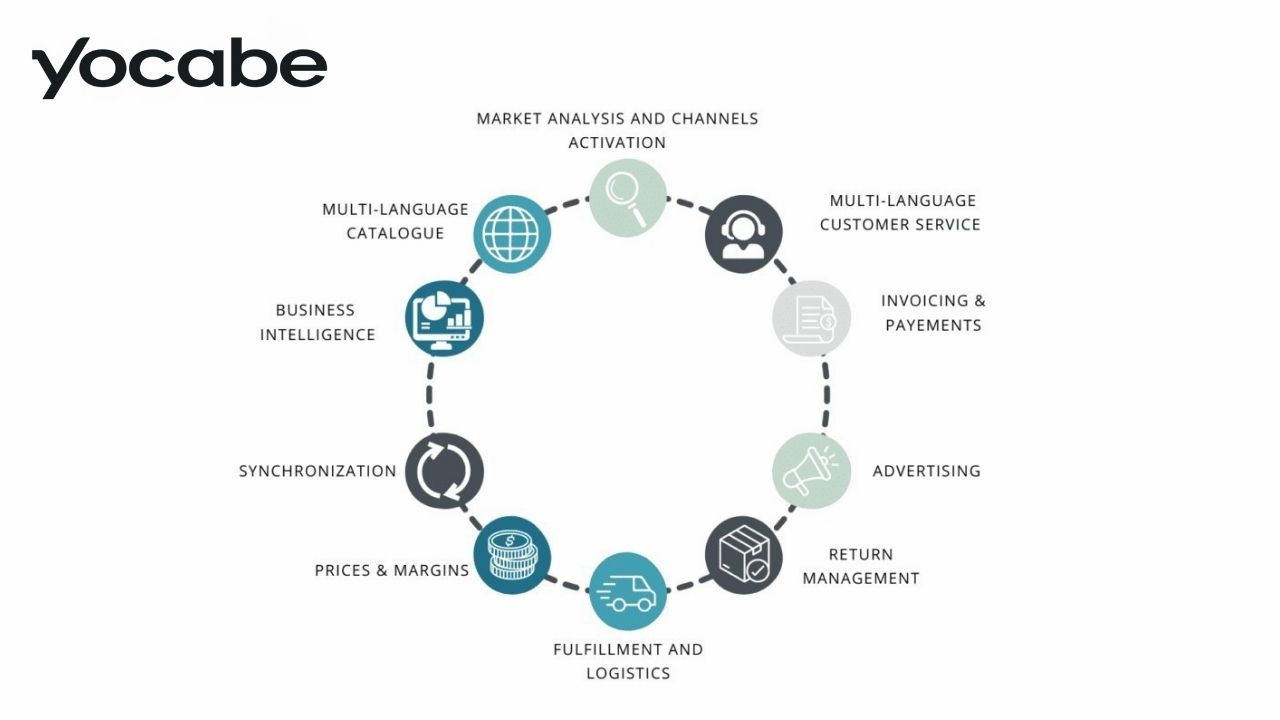

Yocabé: your strategic partner for selling on international marketplaces

Yocabé offers the Merchant of Record service to assist brands in expanding into global marketplaces. With a complete turnkey solution, Yocabé takes over the management of all administrative and tax issues, enabling brands to enter new markets while eliminating the need to juggle complex local regulations.

Services Offered by Yocabe:

Analysis and Fulfillment Requirements:

- Yocabe examines regulatory requirements and obligations specific to each market, ensuring compliance and reducing legal risks.

Consulting and Catalog Selection:

- Provides strategic support in product selection and catalog placement, maximizing effectiveness in the market.

Market Analysis and Competitiveness:

- Conducts in-depth studies on competitors, price positioning and market dynamics, providing strategic insights for optimal positioning.

Operations Management:

- Coordinates logistics, billing, customer service, and technologies needed for effective marketplace operations.

Marginality Analysis and Creation of Profit & Loss Models:

- Develops financial models to predict profitability and effectively manage costs associated with selling in marketplaces.

Technical Integrations:

- Implements advanced technology solutions to integrate brand systems with marketplace systems, ensuring smooth and automated operations.

With Yocabé’s specialized support, brands can make the most of global marketplace opportunities without being overwhelmed by tax and administrative complexity.